The Breast Centre Fee Policy

The medical fee rebate system in Australia is complex. A set of fees for medical services is determined by the Federal Government and known as the Medicare Benefits Schedule (MBS). Most procedures involved in your treatment will have a MBS “item number” and the Government sets a Medicare Benefits Schedule (MBS) fee for each item number.

The MBS fee is used to work out how much Medicare will pay. Medicare pays a benefit of 75% of the MBS fee for in-hospital treatment and 85% of the MBS fee for out-of-hospital services. MBS fees are not the fees doctors charge, they are fees set by the government to manage the benefits paid by Medicare.

As highly trained medical professionals, surgeons are free to place their own value on their professional skills and expertise, and to determine what they consider to be a fair and reasonable fee for the services they provide, and in fact The Competition and Consumer Act 2010 requires medical practitioners to set their fees independent of other medical practitioners, unless otherwise authorised by the Australian Competition and Consumer Commission. Medical practitioners are under no obligation to charge fees that are equal to the Medicare Benefits Schedule (MBS) fee set by the Government or the schedules of medical benefits set by private health insurers.

In setting their fees, surgeons take into account a number of factors including their practice costs. All the costs of running a private practice, which include employing practice staff, all operating expenses and professional costs including medical indemnity insurance, must be met from the fees the doctor charges the patients. The cost of running a practice varies enormously across the country, and both within and between specialties. Rental and running costs for spacious, high quality permanent inner city premises in capital cities are obviously very much higher than for sessional rooms in outer suburban or regional/rural premises, yet the Medicare rebates the surgeon receives are identical in both circumstances, irrespective of the practice running costs.

In a specialty such as breast cancer surgery, where prompt communication with the referring general practitioners is vital, a practice in which correspondence on new breast cancer diagnoses is promptly typed and transmitted to the GP on the day of the patient’s consultation or within 24 hours, requires consistently higher staffing levels, which also in turn significantly increases practice running costs, but is a major benefit to patient care. Practice costs include but are not limited to, wages for practice staff, rent, insurance, electricity, computers, continuing professional development, medical registration, compulsory professional association subscriptions (RACS) and professional indemnity insurance.

Surgeons should satisfy themselves in each individual case as to a fair and reasonable fee, having regard to their own costs and the particular circumstances of the case and the patient. The same operative procedure can vary enormously in both complexity, operating time and aftercare between individual patients, and as such there may be significant variations in the operation fee for the same procedure, depending on the individual circumstances. For this reason, it is not possible for us to provide estimates for operative procedures over the phone prior to a clinical consultation.

Consultation Fee Policy

The Medicare Rebate for an outpatient service is 85% of the MBS schedule fee. The “gap” between the amount charged and this 85% rebate is not covered by your private health insurance for outpatient services, and therefore a financial obligation on yourself arises, and you will face an “out –of-pocket” charge. As a patient you pay 15% of the MBS fee, plus any amount charged by the doctor over the MBS fee. Private health insurers are not allowed to provide cover for doctors’ fees for out-of-hospital services. Medicare benefits levels are fixed arbitrarily by the federal government and benefit levels have not kept pace with inflation, the escalating costs of running a practice and increasing medical indemnity premiums, thereby progressively widening the gap between reasonable fees and Medicare benefits. The fees charged by Miss Jane O’Brien have been determined after careful study and investigation of practice costs and other relevant and material circumstances, and are considered as being fair, reasonable and appropriate for the services provided.

Gaps

Why is there a Gap?

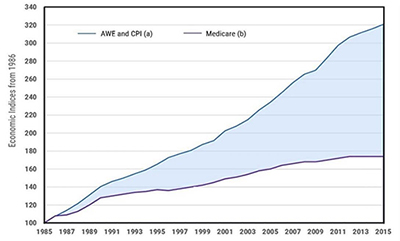

Blue line

a) AWE = average weekly earnings CPI = consumer price index

Purple line

b) Medicare Benefits

The graph above clearly highlights why the gap between reasonable fees based on the costs of running a practice and the Medicare reimbursement has progressively widened.

Operation Fee Policy

When you have in-hospital treatment as a private patient, Medicare will pay 75% of the MBS fee, and your private health insurer will pay the remaining 25% (or on occasions a little more than 25%, if the known gap charged by the surgeon is below an arbitrary limit determined by each individual health insurance fund- commonly $500). The Schedule Fee / Medicare Rebate for an operation covers the normal aftercare customarily provided, as well as the operation itself, and includes attendances in hospital and post-operative consultations after discharge. The aftercare period is the duration of the normal healing process (6 weeks). An additional charge may be made for attendances or services that do not form part of “normal” aftercare.

The MBS fees vary between surgical specialties, breast surgical procedures have historically been poorly remunerated by Medicare relative to some of the other surgical specialties. The breast surgical MBS fees have also not been increased over time to reflect the increasing complexity of modern breast surgical techniques.

In addition, because Medicare benefits levels are fixed arbitrarily by the federal government and benefit levels have not kept pace with inflation and the costs of running a practice, there has been a progressive widening of the gap between reasonable fees and Medicare benefits.

Further compounding the problem is the “multiple operation rule” imposed by Medicare when calculating benefits. For the first item number in an operation, Medicare will pay 100% of the rebate (ie 75% of the schedule fee), for the second item number, 50% and for any additional item numbers only 25% of the rebate. As there are often multiple item numbers involved in breast cancer operations, the multiple operation rule unfairly reduces the Medicare benefit paid.

For example, the schedule fee for a mastectomy without reconstruction (MBS item number 31519) is currently (2018) $ 736.05, of which Medicare pays 75% ($552.05) and your private insurer 25% ($184.01).

If both breasts are removed (bilateral mastectomy), only 50% of the schedule fee is paid for the second side ($368.05), despite the fact that the second mastectomy is exactly the same operation and takes the same amount of operating time as the first. The schedule fee for a bilateral mastectomy is therefore $1104.10. This amount covers the operation itself (which takes several hours) and all post operative care, which includes in-hospital care and post hospital discharge consultations. It includes a detailed discussion of breast cancer operative pathology, and communication to the patient the adjuvant therapy recommendations made by the The Breast Centre Multidisciplinary Team in the weekly multidisciplinary meeting. It also includes the work involved in onward referral to other specialists which may include a medical oncologist, radiation oncologist, fertility specialist and geneticist, and providing all of the respective specialists with copies of all correspondence and investigations reports. Of the $1104.10 schedule fee, Medicare pays $828.07 (75%) and the private health fund pays $276.03 (25%).

Therefore for a bilateral mastectomy, your private health insurance contributes a grand total of $276.03 to the surgical fee, so do not be deceived when health insurance companies (falsely) claim that surgeons fees are contributing to escalating private health insurance premiums. What surgeons charge has absolutely no impact on private health insurance premiums, as the small amount private insurers contribute to the surgeon’s fee is based entirely on the Medicare schedule fee, over which the surgeon has absolutely no control, as it is determined by the government.

If any further procedures, such as an axillary node clearance are also required, Medicare will then pay only 25% of the third, and any subsequent, item numbers, thereby making the more complex operations which involve multiple operative procedures, progressively less appropriately financially remunerated by Medicare, which in turn unfortunately results in higher out-of-pocket fees for these operations.

If any further procedures, such as an axillary node clearance are also required, Medicare will then pay only 25% of the third, and any subsequent, item numbers, thereby making the more complex operations which involve multiple operative procedures, progressively less appropriately financially remunerated by Medicare, which in turn unfortunately results in higher out-of-pocket fees for these operations.

The Breast Centre charges surgical fees that are fair and reasonable, and appropriate for the services provided, based on the complexity of the surgical procedures as well as the expertise and experience required for their performance. These fees have been determined after careful study and investigation of practice costs and other relevant and material circumstances, and are considered as being fair, reasonable and appropriate for the quality and level of service provided. Medicare remunerates all surgeons equally, however the reality is that like all plumbers, lawyers and hairdressers are not equal, all surgeons are not equivalent, and the level of expertise and overall quality of care varies considerably. Whilst it is true that a higher fee does not automatically equate with a better surgeon, providing a high level of care and implementing strict risk management policies is associated with higher practice running costs, particularly related to staffing, which includes clerical staff and the breast care nurse. Things to look for are: Does the breast surgeon have a fulltime breast care nurse to whom you have unlimited access pre and post op in the rooms, and who will visit every day whilst you are in hospital? Did your breast surgeon prioritise their surgical training over income generation during the early stages of their career by spending an extended period of time working overseas to allow the acquisition of new surgical techniques? Will your case be reviewed (both preop and post op) in a formal weekly multidisciplinary team meeting attended by specialists from all the appropriate disciplines? See “Six Questions for patients to ask their breast surgeon before they undergo their breast cancer surgery”

Informed Financial Consent

A financial obligation on yourself (as the patient) will arise when the fee charged for the service is more than the combined (Medicare and private fund) benefits payable. We charge fees considered fair and reasonable and as these fees are usually higher than the MBS (Medicare Benefits Schedule) fees, you will usually face out-of-pocket charges.

What is informed financial consent?

Informed financial consent (IFC) is the provision of cost information to patients, including notification of the likely out-of-pocket expenses (gaps), preferably in writing, prior to admission to hospital.

The Breast Centre has a policy of informed financial consent and should you subsequently be booked for an operation you will be provided with a written quote prior to any procedure, clearly outlining any out-of-pocket expense. The quote is an estimate only, and may change if additional or different procedures are required. The quote covers the breast surgical service only, and does not cover services provided by other doctors such as anaesthetists, plastic surgeons, assistant surgeons, radiologists, nuclear medicine physicians or pathologists, or other costs associated with your stay in the hospital or the day surgery unit, such as accommodation or pharmacy. The assistant surgeon will bill you separately for their fee, and will inform you if there is to be an out-of-pocket charge. There may be an out-of-pocket expense in relation to some of the items for assistance at operations, particularly with some of the more minor breast operations, because the federal government has abolished rebates for assistant fees at many operations. The paramount consideration is patient safety and quality of care and Jane O’Brien will use a surgical assistant whenever clinically appropriate.

Uninsured patients will receive a written quote which will include, in addition to the breast surgical fee, the hospital fees, such as accommodation and theatre fees, which are usually paid by the private health funds. Uninsured patients who hold a valid Medicare card are eligible to claim a Medicare rebate for the medical fees (75% of the schedule fee) but will be responsible for the rest of the costs, including the 25% schedule gap usually paid by the private health fund, the surgeon’s gap, the theatre and bed fee, and the cost of any consumables used, as well as gap fees from other doctors and providers involved.

It is the billing policy of this practice that uninsured patients pay the surgical fee in full at the time of preoperative booking. For insured patients, payment of the out-of-pocket surgical fee is required at the first post-operative visit, with the exception of combined cases with a plastic surgeon, when payment of the out-of-pocket fee is required prior to the planned surgery.

Health funds play a central role in ensuring their members have access to timely information about the cover to which they are entitled and about any excess they may have agreed to pay. Patients who are under the impression that they have full private health insurance, not infrequently discover that they have signed up for very basic “junk” policies which do not provide them with sufficient cover to undergo their breast cancer treatment within the private sector.

You will need the Adobe Reader to view and print these documents.![]()